The Dash cryptocurrency may not be widespread across the world yet, but in Venezuela many restaurants accept it. You can even pay your taxes with it. More than 40.000 people from Latin America have signed up as Dash users, which made for a fine entry point into South America. If Dash achieves a wider adoption in these countries, there could be a significant price increase for the long-term investors.

| At eToro you can trade 49 currency pairs, including several cryptocurrencies. Join eToro |

Dash is a cryptocurrency, which doesn’t try to be anything more than that. In comparison to other blockchain projects, such as Ethereum, where the digital coins are only a part of the whole project, Dash set out to be a payment method and nothing else. The name itself reflects its ideology, as Dash is simply the combination of the words “digital” and “cash”.

There is a number of cryptos similar to Dash that function as payment methods – best known is probably Litecoin. These types of cryptocurrencies generally compete in the following areas: transfer speed, transaction fee, and security/anonymity. In this article, we will describe how does Dash differ from similar cryptocurrencies, and how competitive it is within these 3 areas.

History of DASH

Dash was launched in 2014 with its former name XCoin, which after a month was switched to Darkcoin, and one year later to the current Dash. The creator of Dash is Evan Duffield, but the currency practically functions as a decentralised unit, where decisions are made together with stakeholders – investors, miners, and developers.

In the beginning, Dash had an error which released coins to the miners too quickly. Two days after launch 1.9 million coins have already been released, which gave rise to a form of hyperinflation. Evan Duffield suggested to solve this with a relaunch or an airdrop (a form of a free allocation of tokens of one cryptocurrency), but those involved in Dash said no. Instead, the error was solved simply, without consequences for the miners who already got their pockets full with DASH. Dash started to be traded at a low price of about $0,23, as there simply were too many of the digital coins on the market in a very short time.

With time, Dash rose to $355 at the time of writing (23rd of May, 2018), reaching its peak in December 2017 with the price of 1.584 USD. Had someone been interested in Dash since the moment it arrived on the market in 2014 and sold it at its peak in December last year, the profits would reach almost 700%. The kind of extreme price increase (and the story about it) that makes the cryptocurrency environment so exciting for many investors.

With time, Dash rose to $355 at the time of writing (23rd of May, 2018), reaching its peak in December 2017 with the price of 1.584 USD. Had someone been interested in Dash since the moment it arrived on the market in 2014 and sold it at its peak in December last year, the profits would reach almost 700%. The kind of extreme price increase (and the story about it) that makes the cryptocurrency environment so exciting for many investors.

| At eToro you can trade 49 currency pairs, including several cryptocurrencies. Join eToro |

Dash today

Currently, Dash is a recognised cryptocurrency with a market cap of $2,741,464,649 USD at the time of writing, sitting at the 12th place of largest cryptocurrencies by market cap, calculated by multiplying the number of coins on the market (in Dash’s case, 8,088,133 coins) by its price ($338.95 at the time of writing). The currency has a cap of 18,900,000 DASH, which means that coins will continue to be released until that number is reached, after which no more Dash coins will be created.

Dash is a decentralised autonomous organisation, as control of the cryptocurrency development and all the decisions are carried out by those involved, and those that should be paid (for example miners), get it automatically from the system. Everybody can participate, and those that take on various roles, earn different advantages. There is a Dash Core Team made of developers who run the system and in return get paid by it in Dash.

Dash promotes several of its features that make it a particularly good cryptocurrency, including decentralization and inflation.

Decentralisation

As mentioned earlier, as part of the widespread, decentralised autonomous policy, Dash is run by those involved. In order to take part in voting on Dash’s future, you have to own a masternode, which requires ownership of 1000 DASH. Since 1000 DASH costs 338.950 USD, a great deal is required in order to obtain the right to vote. Which leads to the fact that Dash’s positive development is in every participant’s self-interest. Miners take care of creating new blocks, and other basic network functions, while Masternodes help to run more everyday functions.

Masternodes are particularly involved with running the following two functions, InstantSend and PrivateSend. The former runs transactions with next to no delay. It’s possible because transactions are approved by masternodes, without having to go back to the block or the blockchain to check it again (which is the normal process). Dash’s way allows a transaction to take 1,7 seconds, which is faster than the majority of other cryptocurrencies.

Masternodes are particularly involved with running the following two functions, InstantSend and PrivateSend. The former runs transactions with next to no delay. It’s possible because transactions are approved by masternodes, without having to go back to the block or the blockchain to check it again (which is the normal process). Dash’s way allows a transaction to take 1,7 seconds, which is faster than the majority of other cryptocurrencies.

PrivateSend allows for private transactions. More precisely, it combines transactions with the same amount, redistributes them so that all recipients still receive what they should, but the source of each transfer is almost impossible to determine.

Dash utilises a 2-layer network, consisting of both blocks and masternodes, and those who run them divide profits between themselves, except for 10% that goes back to maintain Dash, more specifically to a pool called Sybil. Sybil is a treasury where 10% of the profits from operating blocks/masternodes return to, thus ensuring that new projects will be able to get funding.

Those who have the right to vote can take part in decision making, thereby ensuring that projects who may have a positive effect on Dash will receive appropriate financial support. This creates a kind of a self-reinforcing ecosystem, where funding generates increased growth, which leads to more funding, which facilitates further growth.

| At eToro you can trade 49 currency pairs, including several cryptocurrencies. Join eToro |

Inflation

In order to curb inflation, the amount of DASH released to the miners is reduced every year. This process attempts to create a stable inflow of new coins, thus stabilising the value. By the year 2300, there will be around 18 million DASH on the market, after which point no more will be created. Already from 2111, there will be a maximum of 1000 new DASH on the market each year (if the cryptocurrency still exists at that point).

The amount of DASH coming to the market varies to some degree, depending primarily on the block rewards and the previously mentioned treasury system (Sybil). Since the latter is a pool for financial support of new projects, it may not be fully utilised if new projects don’t resonate positively within the environment. Therefore, those coins that were not distributed could go back to the coffer, thus reducing the supply of DASH.

Block rewards, as the name suggests, relate to dividends received by miners in exchange for mining blocks. In order for the system to run optimally, there is a limit of about 79 Gigahashes per second – hashes can be treated as the power that runs the blockchain. At this limit, the Dash system runs the best. The running cap is an attempt to achieve stability by affecting mining profitability on the network. When the network runs higher than the cap, the mining reward is reduced, thus disincentivizing miners. On the other hand, when the network runs below the threshold, the reward is increased, attracting the miners. It is important to mention that miners switch networks often and quickly, depending which cryptocurrency is currently most profitable to mine.

All of this is a technical explanation of how Dash functions, and what does Dash promise to deliver. However, to understand what that means for Dash in the future, we first have to take a look at how competitive Dash is across the previously mentioned areas: transfer speed, transfer fees, and security/anonymity. This will also allow us to paint a possible picture of Dash future position on the crypto-market.

Comparing Dash

With InstantSend, Dash has a transfer rate of 1,7 seconds, which we can now compare to other cryptocurrency competitors.

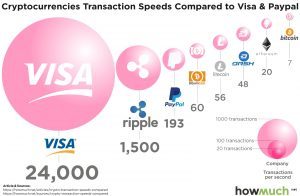

Scalability that allows for worldwide adoption is an important parameter to investigate how a cryptocurrency will fare on the market in the future. A comparison point could be the amount of cleared transactions per second.

The picture below shows an overall snapshot of cryptocurrencies and other market players (from January this year):

Visa: 24.000 coins / sek.

Visa: 24.000 coins / sek.

Ripple: 1.500 coins / sek.

PayPal: 193 coins / sek.

Bitcoin Cash: 60 coins / sek.

Litecoin: 56 coins / sek.

Dash: 48 coins / sek.

Ethereum: 20 coins / sek.

Bitcoin: 7 coins / sek.

Based on these numbers, it can be seen that currently none of the cryptocurrencies can catch up with VISA. However, VISA has had 60 years to develop, while cryptocurrencies could still be considered young. Cryptos are still developing, and very rapidly at that. Bitcoin, for example, has begun to use the new system to handle transactions, Lightning Network. Other cryptocurrencies, such as Litecoin, have implemented another scaling solution called SegWit.

The Dash environment has completely rejected this solution, as they believe that Dash could get worse after implementing either SegWit or Lightning Network. It is believed that Dash already has the best, most secure system compared to other solutions. Therefore, Dash should develop in its own direction.

If you read various fora, like Reddit for example, this discussion becomes borderline religious. And only time will tell who’s right. With the implementation of the Lightning Network, Bitcoin (or Litecoin) may outcompete other cryptocurrencies (like Dash or IOTA) that have marketed themselves as a cheaper, quicker and more secure alternative to Bitcoin. But it can also turn out that Dash’s technology is so strong that in the long term it is more secure and better functioning than Bitcoin’s Lightning Network – as claimed by the Dash team. But it remains to be seen who will turn out to be right.

Dash will never become as anonymous (or private) as one of the other big cryptos – Monero (XMR). Which begs the question, what could be Dash’s competitive advantage?

If Dash is to survive as a cryptocurrency, it may well be due to its versatility. The currency doesn’t have one particular advantage in one particular area. Instead, Dash offers solutions to a number of areas, such as speed, anonymity and price per e.g. transfer. It could be perceived as a package solution that is not best for one specific area, but rather provides exciting solutions in numerous areas.

Dash has a big and active following, as well as a pool of around 4 million USD to support its development every month. It may be possible then for Dash to reinvent itself and prove its long-term durability – right now Dash technically lacks evidence that it’s here to stay.

Besides technical factors, there are other ways to justify an existence of a cryptocurrency – as exemplified by Dash’s exciting initiative in Venezuela.

Dash lends a helping hand to Venezuela

It is thought that the most exciting cryptocurrency developments will happen in the third world. In the West, we often talk about how cryptocurrencies are competing with banks and established fiat currencies like dollars, euros, etc., and what are competitive advantages of fiat money and cryptocurrencies. But we often forget that many people from 3rd world countries have access to neither banks nor a stable currency. Which is why cryptocurrency has a better chance of gaining a foothold in these countries – they may already be seen as a better and more inclusive alternative compared to existing payment solutions.

This opportunity has been noticed by a woman named Eugenia over a year ago, as she presented the idea to try and implement Dash in Venezuela, due to hyperinflation and overall bad and unstable economy of the country. Eugenia applied for funds from Dash’s treasury system (Sybil), and received support from the environment and resources to make her project come to life.

Since September 2017 Dash has held conferences in Venezuela, and a pool has been opened, whereby Venezuelan citizens could get free Dash, if they signed up as users on the network, and downloaded Dash’s payment solution on their phone or computer. This has led to over 40.000 registered Venezuelans, which in the crypto world is a significant increase in the number of users.

Since September 2017 Dash has held conferences in Venezuela, and a pool has been opened, whereby Venezuelan citizens could get free Dash, if they signed up as users on the network, and downloaded Dash’s payment solution on their phone or computer. This has led to over 40.000 registered Venezuelans, which in the crypto world is a significant increase in the number of users.

If this idea becomes a widespread trend, there are massive development opportunities for Dash in Venezuela, a country with 31 million citizens. While it may sound like it may never happen, or that it may take a long time, the Venezuelan economy is so bad that president Pedro Maduro has launched a cryptocurrency – Petro.

Petro is a cryptocurrency that is tied to the value of oil. It was launched in February and March this year, and president Maduro has claimed that the currency has raised over $735 million. However, there are voices saying that the president isn’t trying to stabilise the economy, and is instead lining his own pockets.

Nevertheless, a cryptocurrency in an economy like the Venezuelan one can easily prove to be a real and more effective alternative – even in the short term – and if Dash gets a hold of this market, the future may turn out to be really exciting.

In connection with a blockchain conference, ASEAN (Association of Southeast Asian Nations) has recently announced that Cambodia is considering launching their own cryptocurrency called Entapay, and Cambodia’s national bank has been previously involved with a blockchain company, namely the Japanese Blockchain Identity.

A press release from ASEAN stated that the cryptocurrency can be used by the country to manage the inflation, but also to avoid West’s economic sanctions.

Third-world countries are home to the majority of the unbanked people and unstable economies. Venezuela is just one example, Zimbabwe in Africa can be another one. As such, these areas may prove to become explosive markets for cryptocurrencies, as well as their first step towards mass adoption and use.

In this sense, Dash may have an early competitive advantage, provided it manages to prove itself useful in Venezuela. If this happens, the floodgates for a market with billions of people will open.