The fact that there are many ICO scams out there won’t surprise anyone. But there are steps one might take to avoid getting scammed. Firstly, several aspects of a project need to be evaluated before investing, such as the product and the team behind it. Secondly, there are a number of red flags to be aware of, such as lack of transparency, focus on marketing rather than good product/code, insufficient information, etc. We have covered in detail what to look for in an ICO here.

| At eToro you can trade 49 currency pairs, including several cryptocurrencies. Join eToro |

In this article, a whitepaper of a confirmed ICO scam, PlexCoin, will be analysed. PlexCoin was mentioned in our article about lessons learned from ICO scams. We have chosen this whitepaper as the focus of this article, because, as we wrote in another article, PlexCoin whitepaper could serve as an ICO red flag guidebook.

What happened?

In the summer and fall 2017, PlexCoin has been offered as a new cryptocurrency. Several features have been promoted, such as PlexWallet, PlexBank and a PlexCard. And most importantly, it was promising returns of 1354% in less than a month. During their ICO, 15 million USD has been raised. However, on December 4th the SEC froze PlexCorp’s (company behind PlexCoin) assets and brought charges against the founder Dominic Lacroix, his partner, Sabrina Paradis-Royer, and the company for securities fraud. And thus a lengthy legal battle began. A few days later, Canadian authorities sentenced Lacroix to two months in jail as well as fined PlexCorps $100,000. In March 2018 SEC started seeking sanctions against the founders, as they refused to provide documents related to the ICO, claiming they kept few records. Two months later the situation repeated, as Lacroix and Paradis-Royer still failed to provide the necessary information. In June, SEC froze Lacroix’s assets, as they suspected that he was secretly transferring the capital raised via the ICO for his personal use. Finally, in July, Lacroix was forced by the court to return any bitcoins in his possession, and soon transferred $3.7 million in BTC to the court. As Radio Canada reported at the beginning of September, the assets of both Lacroix and Paradis-Royer remain frozen.

Almost a year since the initial asset freeze by the SEC, and there are still some investors on PlexCoin’s Facebook page asking for an update or for their money back… Let’s take a look at the whitepaper, and see if some of the troubles that followed the ICO could’ve been spotted earlier, and avoided by investors.

PlexCoin Whitepaper

The whitepaper is available here. Let’s dive right in.

Transparency is everything, right?

‘Trustless trust’ is a concept often mentioned within the Blockchain environment. It refers to being able to transact with strangers with no intermediaries thanks to how blockchain transactions are cryptographically coded. Privacy overall could be considered one of Blockchain’s ideals. But some scammers, as shown below, twist the idea behind privacy, giving very sketchy excuses.

“We know that eventually, we will have to display the names of some of our executives. However, we will try to remain discreet until all of our projects are launched. Nonetheless, we will never mention the names of our employees and subcontractors. This rule is paramount for our projects’ security and for the people around us to remain safe.”

BIG red flag there. Assessing the skills, experience, and trustworthiness of the team is one of the essential steps of evaluating an ICO. Citing security as an excuse not to disclose the names of the team members makes no sense. But PlexCoin goes even further.

“How do you want us to be able to guarantee you a total confidentiality if we reveal our identity? Any organization could then contact us, visit us and scrutinize our operations (and yours)! This is not what we want.”

They are downright telling you they don’t want to be found and examined too closely (or at all). Red flag, obviously.

PlexCoin (and many scammers in general) often say something that sounds very good, but provide little to no additional information. For example:

“We thus deal with a sister company that issues VISA cards and that meets our expectations.”

Crypto-based debit cards are quite useful, as they allow users to easily move and convert their cryptocurrency to the card. But the devil is in the details. What’s the name of the sister company then? Not provided.

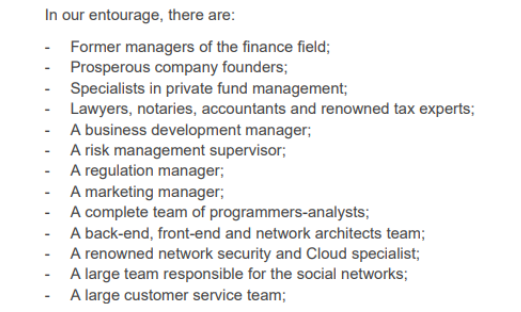

Only the bestest for the team

The full description of the team is as follows:

And later continues:

“A lot of PlexCorps’ team members have solid experience with cryptocurrency and with blockchain technology. Indeed, we hire the best people of [sic] each area.”

No further information about the team provided, of course.

While this is clearly insufficient information, it should be noted that not all companies include their team description in the whitepaper. Technically, they are not obligated to, as whitepapers have no set standards whatsoever. However, not including the team in the whitepaper is better than spinning the bullsh*t like PlexCoin. Ark, for example, one of the most successful ICOs, provides no information about their team in the white paper. Instead, the team is presented on their website, with links to their LinkedIn profiles (remember to always check the information on the social media profiles!), and CTO’s Github page.

In short, no team description in the whitepaper is not inherently suspicious, as long as that information is provided on their website.

Embellishments and unsubstantiated claims

During an ICO a company needs to promote and (literally) “sell” their idea, so you can quite easily find various embellishments relating to either a company or its product (we will disrupt [insert industry], etc.). Our ICO-scam-red-flag guidebook provides a lot of examples. Here are just a few:

“We are not funding a standard credit card company or an insurance decentralization company. We are talking about a major change in the financial system.”

“We are convinced that our projects will make today’s banks almost unnecessary.”

“Moreover, our interfaces are more ergonomic and user-friendly than those of the competition.”

“PlexCoin’s revolutionary operational structure is safer than that of current cryptocurrencies and is a lot simpler to use.”

“This (sale) level offers the best return on investment ever offered by an ICO.”

A company claiming to be better than competitors is not inherently suspicious. What does raise doubts is when a company only makes claims, without providing actual evidence of how exactly can they achieve results better than other firms on the market.

Inciting FOMO

A classic move used by the majority, if not all, ICO scams are inciting FOMO – Fear of Missing Out. It describes anxiety or fear that one may “miss out” on an opportunity.

“Cryptocurrency transforms the world. It will create an unprecedented positive social impact. You may decide to watch the train go by, or you may take part in a historical moment and support us in this journey. ”

“Important: You are free to not take part in this ICO if the fact that we are remaining anonymous in order to provide a competitive product makes you uncomfortable. You can watch the train go by and lose the chance to be part of a great change if this is what you wish.”

We thought only annoying teenage girls could reach such level of passive aggressiveness…

Simply not true or just laughable

The sheer fact that this section was needed gives you an idea of how bold some scammers are. Here are a few examples from our scammy guidebook, and trust us, there was a lot to choose from.

When explaining how PlexBank would work:

“Here is an example. You own 100 Ethereum, of a value of US$ 100 each, which equals to a US$ 10 000 total value. You leave on a trip in a few hours and you decide to freeze your asset through PlexBank. When you come back from your vacation, you notice that the Ethereum value has dropped to US$ 60, a loss of US$ 40 per Ethereum. Since you have frozen your asset before you left, you still own a value of US$ 10 000 in your PlexBank account. Therefore, if you unfreeze your money, PlexBank will not deposit 100 Ethereum in your account, it will deposit 166.66 Ehereum, of a total value of US$ 10 000 because of the current cost of the Ethereum.

This will be one of the options offered by PlexBank. This is something that does not exist at the moment of writing these lines. We are confident about the success of this option.”

They are right. This does not exist anywhere else. Because it can’t. If you can’t know how much the price will rise and fall, who would take the risk and guarantee the amount? If the price drops 20, 30, 40% in a short period of time (which we’ve seen repeatedly), no company in their right mind would be willing (and probably) able to cover the difference.

Here are a few other statements:

“PlexCoin may be used just like traditional money to pay bills (…) ”

This is at the very least a very misleading statement. While it is possible to pay your bills with cryptocurrencies, it is possible with Bitcoin or the major coins (Ethereum, Litecoin, etc.). Saying that you could pay your bills with PlexCoin is so far-fetched we consider it to be an untrue statement. Moreover, this is the only time that the whitepaper mentions this useful feature. Here are just a few more examples:

“Revolutionary and unprecedented, PlexCard will be accepted everywhere in the world, regardless of your country’s currency. Your card will adapt to the geographical area in which you are located”

How a card can adapt to a geographical area, we have no idea. And as this is the only mention of it, we assume neither does PlexCoin.

“We already hear that PlexCoin could be the next Bitcoin, which is very flattering. It is virtually our main goal.”

I heard that I could be the next Nobel Prize winner, which is very flattering. It is virtually my main goal.

Who told me? Mine and PlexCoin common imaginary friends.

“PlexCoin’s purchase price and its value during pre-sale are two different concepts. Its value relies on an algorithm that will make it increase at each transaction.”

This statement was one of the reasons why we added “just laughable” to the head of this section. Price of a cryptocurrency cannot be determined by an algorithm (with the exception of Tether, which is coded to be pegged to the US dollar).

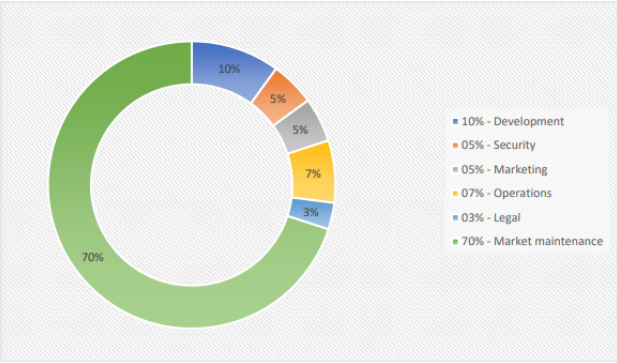

Budget

Budget allocation helps potential investors understand how a company will divide raised capital. Here’s PlexCoin’s:

“Our budget structure allows for a large part to be used for market maintenance. This will ensure a consistent increase of PlexCoin’s value, even if members sell their assets massively.”

Fun fact: the term market maintenance does not exist. The term means nothing. It is explained as follows:

Fun fact: the term market maintenance does not exist. The term means nothing. It is explained as follows:

“The major part of the pre-sale earned funds will be reserved for this use. Our market maintenance team will remain on the lookout for PlexCoin’s value fluctuations when it will be launched on the market. The team will limit the value decreases by buying if the value drops. (…) We will thus guarantee a rather steady increase of PlexCoin’s value and will avoid high price fluctuations in case of mass purchase or sale from our members.”

This actually exists. It’s called buybacks. They are used in the stock market to decrease the number of available shares and manage their valuation.

| At eToro you can trade 49 currency pairs, including several cryptocurrencies. Join eToro |

Another fun fact: do you know which financial assets buybacks apply to? Securities. And PlexCoin is self-described as “an entirely decentralized open code global currency”.

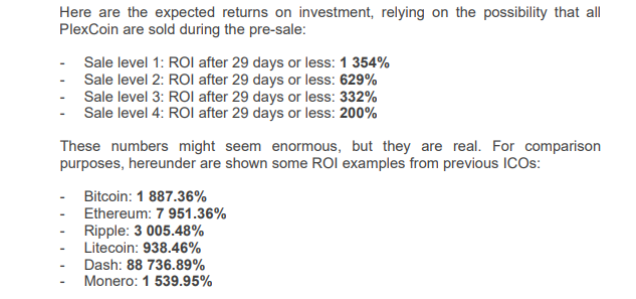

ROI, AKA: promises, promises…

Such a comparison is just dumb. Just because some ICOs get an amazing ROI, it doesn’t mean that yours will. Making such a statement would be like me saying:

I’m not gonna go to college, and I’m gonna become a billionaire.

This might be an enormous achievement, but it’s real. For comparison, here are some examples of people who didn’t finish college and their net worth:

Steve Jobs: $10,2 billion

Michael Dell: $23,5 billion

Larry Ellison: $61 billion

“We estimate an approximate unitary value of US$ 8.50 before the end of the year 2017, and a value of US$ 14.00 per PlexCoin by the end of 2018.”

This is simply ridiculous. The market decides the price. Any sort of estimation regarding the price of the token should be taken with a bucket of salt. We’d say a grain of salt, but we fear it might not be enough. The reason is simple, these estimations are based on arbitrary numbers. So they’re more wishful thinking expressed in numbers, rather than calculations a potential investor can trust.

And again, if a company does provide some estimations relating to their future (token price, number of users on the platform, etc.), it does not immediately mean they are a scam. However, every investor needs to decide whether these estimations are realistic, and how the ICO replies when prodded about them. Do they provide some arguments for their numbers, or do they get defensive and incite FOMO (“if you don’t want to invest with us and join this great movement, you don’t have to”, or “you are free to let this amazing chance to get rich pass you by”, etc.)?

Terms and conditions

Terms and conditions are a vital section of a whitepaper. They essentially reflect the contract made between an investor and the company making a given ICO. The PlexCoin whitepaper consists of two points. Two. Basically, the contract states that it is governed by laws of Singapore, and any disputes should be first directed to mediation in Singapore. The second point is acknowledgements. That’s it, that’s the whole contract. But don’t worry, it’s not a red flag. It’s a beaming, flashing neon screaming “NO. NOPE. HELL NO”.

Conclusion

If you think that we were just nitpicking the worst sounding fragments, we strongly recommend you to read PlexCoin whitepaper. It’s actually quite funny how ridiculous some of the claims are. Until you learn that the ICO managed to raise around $15 million…

We should also mention that while this whitepaper was SCREAMING “scam”, many other fraudsters are much better at imitating legit companies. But PlexCoins ridiculous claims made us laugh, so we decided to share some of the most insane statements.