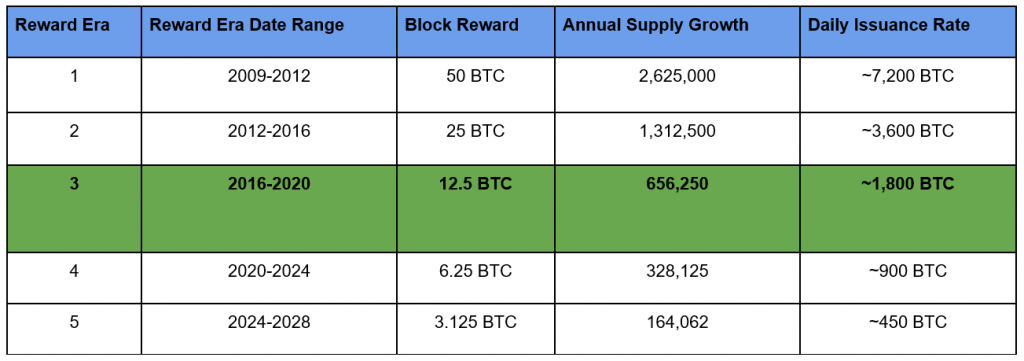

In May 2020, a milestone event will occur in the cryptocurrency world. The production of new bitcoin will be halved so that 1800 bitcoins are no longer produced per day, but only 900.

Solid and proven mathematical models show that the price of Bitcoin can reach a minimum of $ 55,000 in 2020-2021 due to the limited supply. These are mathematical models that the price of Bitcoin has so far followed with incredible accuracy. Below you will find an explanation of why the price may soon reach $ 55,000, what is the likelihood of it happening and what are the arguments against it.

| eToro is the world’s leading brokerage platform for social and copy trading. A 1000 different products are available on eToro, divided into 12 stock indices, 7 commodities, 53 ETFs, 49 currency pairs, including several cryptocurrencies (e.g. Bitcoin and Ethereum). Leverage of up to a 100 (leverage degree differs for some assets) is available. In our opinion, eToro is the best regulated exchange. You can join eToro here |

Bitcoin halving in the spring of 2020 will be an absolute highlight of the cryptocurrency ecosystem, as it only happens every four years that the number of newly issued bitcoins is halved. So far, a total of 18 million bitcoins have been produced, and the final number of bitcoins will be 21 million – in more than 100 years, more precisely in 2140. This means that in the long term Bitcoin can gain the status of digital gold, as it is an asset that is rare and which many people would like to own.

Historically, Bitcoin has halved the production of new cryptocurrency twice, in 2012 and 2016, and in both cases, this has led to extremely positive price developments. In the following, we will look at what we can learn from history and the arguments for and against history repeating itself.

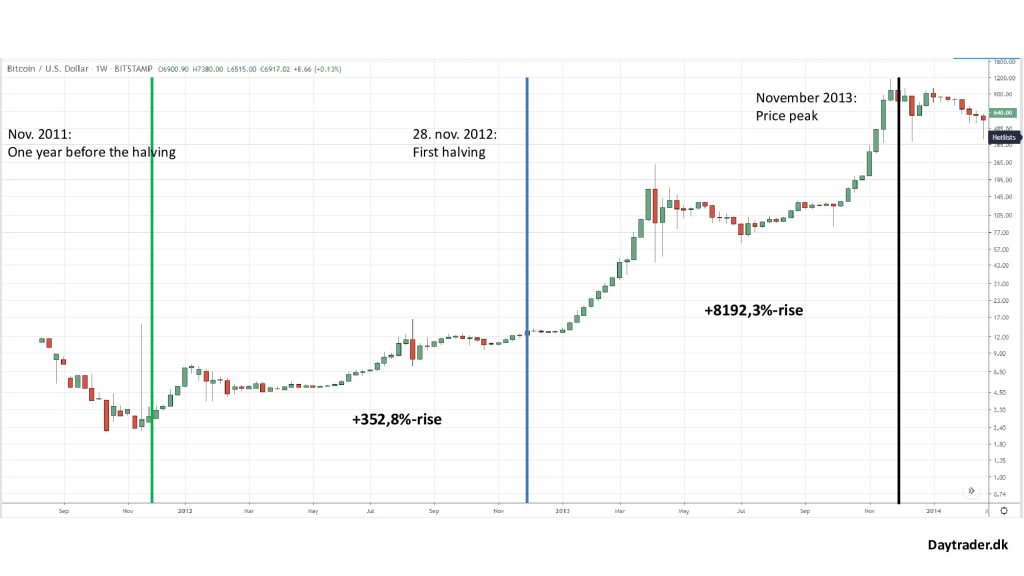

The first halving

On November 28, 2012, the first halving took place. If one looks at the price trend up to halving, and after it, a trend leading to a sharp increase in the price can be seen. In the year leading up to halving the price increased by 352.8%, and in the year following the halving an increase of 8192.3% followed by a high of around $1200 for a bitcoin in November 2013. In connection with the first halving, the number of newly issued bitcoin has been reduced from approximately 7200 to 3600 new bitcoins per day.

The price trend can be seen on the graph below:

After, in December 2013, Bitcoin entered a negative period, partly because the well-known Bitcoin exchange, Mt. Gox, was hacked. The price of bitcoin then lost 80% of its value and a reversal only began in earnest when the prospect of the next halving was coming.

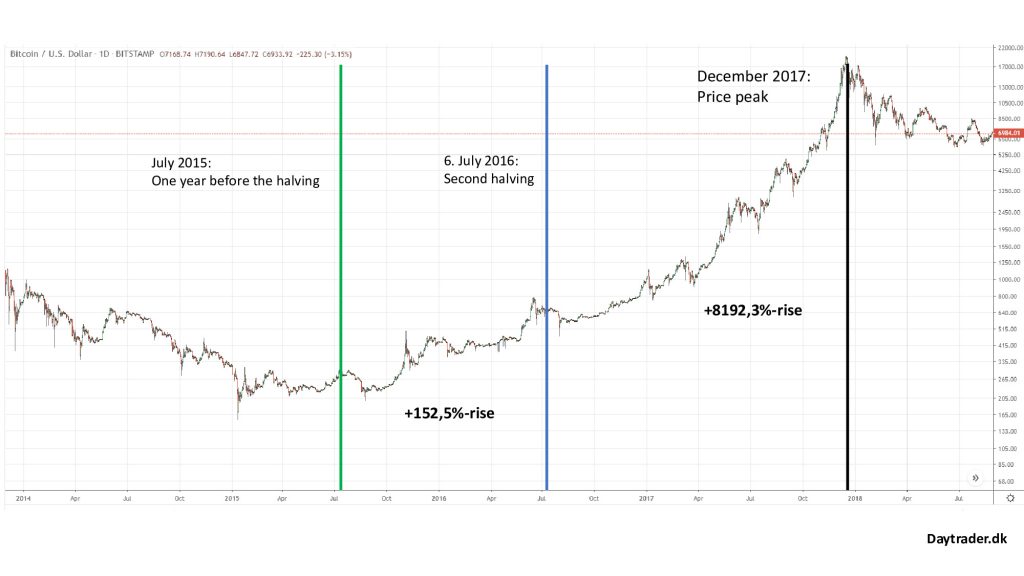

The second halving

Price developments connected to the second halving, which came about on 6 July 2016, followed the same pattern. In the year leading up to the halving, the price rose by 152.5% and it was particularly positive in the last 9 months up to the halving. After the halving, a small drop followed, but then came a very sharp increase of 2818.5% in the next 17 months. The trend in the price can be seen on the graph below: The third halving – 2020

The third halving – 2020

Around mid-May 2020, the number of newly issued bitcoins will be halved yet again, and the entire cryptocurrency ecosystem is obviously focused on whether the history will repeat itself. If you draw a parallel to the previous halvings – and the price follows the same pattern this time – then you should expect a three-digit percentage gain in the year before the halving. One year before halving, the price was approx. $8350 for a bitcoin, and as of writing (January 2019) the price is below this level.

If the pattern of the most recent halving will follow, the price will more than double towards the halving, thus reaching at least $16700 during the period leading up to the halving. After the halving one should experience even stronger increases in the following year and a half. Of course, it is only a hypothesis based on what will happen to the price if you use the earlier increases to model the price development.

Awareness of the halving is greater in connection to the third one, which is why some perceive the price increase to $13,000 experienced earlier this year as an attempt to “get ahead” prior to the halving. Since then, the price has dropped substantially, but in connection to the new year and with less than six months left before the halving, it is likely that Bitcoin’s price will gain focus again soon. If you start to see nice increases in the price, it can once again have a self-reinforcing effect – many know that a scenario where the bitcoin price is multiplied can be played out, and as an investor, you do not want to miss this possibility. If Bitcoin and cryptocurrencies turn out to be the future form of money, then there are many who would be upset if they hadn’t taken a small bite of the cake. In the investment world, this effect is known as FOMO – Fear Of Missing Out.

To understand why halving bitcoin has had such a positive impact on price, it is important to familiarize yourself with some of the mechanisms behind it. Right now, about 1800 bitcoins are being produced a day. After the next halving, that figure will drop to 900. Those who extract bitcoin – the so-called miners – will often be net sellers in the market as they have to pay for electricity and other things to keep the operation running. After the next halving, where only 900 bitcoins will be produced per day, fewer new bitcoins will be put up for sale. That in itself can have an impact on the price.

The table below shows how the halvings look like in the past, and how they look like in the future:

[Source: Medium]

[Source: Medium]

From the above table, it follows that over time it will become increasingly costly to produce a bitcoin, as the profits given to miners will be halved. If the cost of producing a bitcoin doubles while fewer bitcoins are being produced, it may mean that bitcoins are perceived as rarer. Following this, the price may rise.

How to buy Bitcoin

If you would like to start trading Bitcoin, you can quickly get started – for example, with the eToro trading platform where you can trade bitcoins – both in the form of contracts, as well as in the form of real bitcoins that you can deposit and withdraw from a wallet. Here is an overview of why and how to invest in Bitcoin.

| At eToro you can trade 49 currency pairs, including several cryptocurrencies. Join eToro |

Comparing Bitcoin to gold

Over the past two years, the price of bitcoin has fluctuated between less than $4,500 and almost $18,000 for a single bitcoin. At the same time, there has been no shortage of people on social media who have called the cryptocurrency a scam, paper money or a pyramid scheme. Without deciding who is right and who is wrong, one can see that the critics disagree with the market as a whole, which over the years has seen quite a high – albeit very fluctuating – price of bitcoin. In practice, owning a bitcoin at the moment is equivalent to having a small piece of gold in hand, but many people find it difficult to relate to something that exists only in digital form – something that one cannot hold in their hands.

At the same time, Bitcoin has also introduced the idea of a non-replicable digital object, and the consequences of this invention are far more widespread than many realize. Proponents of cryptocurrency argue, among other things, that one can relatively easily counterfeit or copy ordinary money, but with cryptocurrencies like Bitcoin, it is practically impossible, and in this way, a currency like Bitcoin is favourable over the traditional currencies.

When comparing Bitcoin with gold and other rare metals, you can see that there are some striking similarities. And these similarities can be used to understand why the market values a bitcoin at its current level, and why some observers believe prices could multiply over the next two years.

Bitcoin – a rare, digital object

One of the most interesting and thorough analyses of Bitcoin comes from a Twitter user Plan B, who, in the same way as the inventor of Bitcoin, has chosen to remain anonymous. He works for a large hedge fund in the Netherlands, which probably doesn’t want to broadcast his message about cryptocurrencies. Despite the anonymity, his analysis has gained a wide reach beyond the crypto environment and has been translated into over 20 languages. He also participated in a podcast with millions of listeners.

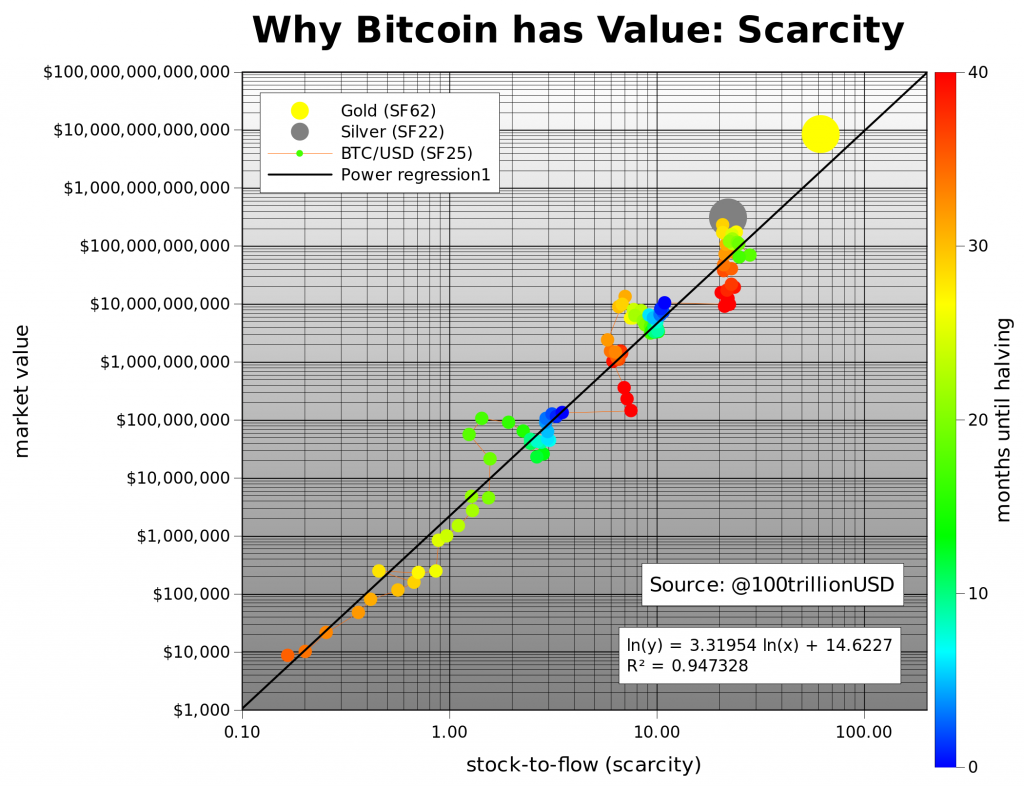

Plan B’s analysis is that, at present, it is obvious that a rare, unique digital object such as Bitcoin has value – this can be seen in the market value over the past few years. The question revolves around how much the value is, or should be.

If you model Bitcoin’s value in the same way that you model rare metals, you will find some very strong similarities. In the book “The Bitcoin Standard”, Saifedean Ammous described how rarity can be derived from a model called “Stock to flow”. It is simply a matter of measuring how much of a particular material is produced each year (= flow) in relation to the total supply (stock). The relationship between the two values is stated as “SF” and that value says something about how rare the material is. Gold and Bitcoin are significantly different here compared with industrial metals such as copper, zinc, nickel and bronze because they have a high Stock to flow (SF) value.

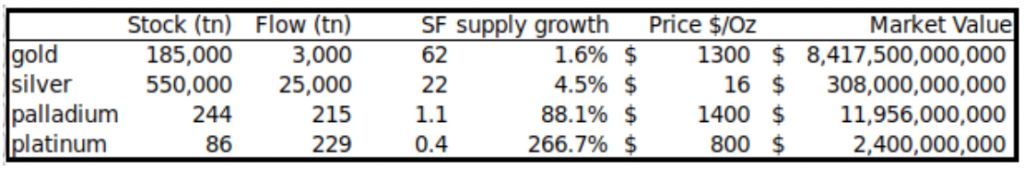

Gold has the highest stock to flow value, at present 62, which means that with annual production at the current level, it will take 62 years to extract all the gold that exists in the world. The SF value of other metals can be seen in the table below:

[Source: Medium]

[Source: Medium]

Silver has the second-highest SF value, which means that both gold and silver are sought after metals because not much is produced in relation to the total supply. Palladium, platinum and other commodities have an SF value that is barely higher than one. Here, the existing supply more or less corresponds to the annual production, and thus production becomes an important factor.

At the time of writing, there are approximately 18.1 million bitcoins and 657,000 new bitcoins are produced annually at the current pace. It gives an SF value of 27.5. Higher than silver, but lower than gold.

| eToro is the world’s leading brokerage platform for social and copy trading. A 1000 different products are available on eToro, divided into 12 stock indices, 7 commodities, 53 ETFs, 49 currency pairs, including several cryptocurrencies (e.g. Bitcoin and Ethereum). Leverage of up to a 100 (leverage degree differs for some assets) is available. In our opinion, eToro is the best regulated exchange. You can join eToro here |

Bitcoin worth $55.000 – $90.000?

But by 2020, when the number of new bitcoins is halved, the cryptocurrency will reach an SF value close to gold. And then it starts to get interesting. The hypothesis is that the total market value – and thus the price of the metal, or bitcoin – is very closely related to the SF value. And if you test this hypothesis, you can see something very startling, namely that there is a statistically significant relationship between the market value of an asset and the SF value. In mathematical terms, the model has a very high explanatory power (R2 value) of 95%, which means that the chances of this being a coincidence are close to zero.

Of course, the price of Bitcoin is also influenced by other factors, e.g. legislation, hacking of crypto exchanges, and other news, but the dominant factor appears to be the SF value – the ratio of annual production to total supply.

The interesting thing is that gold and silver are relatively in line with Bitcoin values. For example, in December 2017, Bitcoin had a market value of approx. 230 billion and an SF value of 22, which was very close to the SF value of silver.

After the halving, Bitcoin will have an SF-value of 50, which is very close to gold with a value of 62. According to the model, the market value of bitcoin will be $1 trillion, which is equivalent to the price of single bitcoin being $ 55,000-90,000, depending on how you round up and interpret the numbers. Looking at price trends after the previous halves, however, it may take up to a year and a half after the halving before the market reaches this point.

If you are interested in hearing more about the argument in favour of Bitcoin’s rise in price, we recommend listening to The Investor’s podcast, which “Plan B” hosted in September 2019. It is the world’s largest investment podcast:

For Bitcoin, the halvings have had a very large influence on the price, which can be seen on the graph below with different colours.

Dark blue represents the month of the halving and red is the period just after it. The graph is a logarithmic scale and, as can be seen, there is a clear correlation between the SF value of precious metals such as gold and silver and Bitcoin’s SF value over time. If the hypothesis holds for the next two halvings, Bitcoin will be able to obtain a market value that corresponds to the market value of gold.

It would give the value for a bitcoin of at least $55,000 at the first halving, and should Bitcoin reach the same market value as gold in connection with the 2024 halving, where the SF value would be higher than gold, the price of a bitcoin would be between $400,000 and $1,000,000. Below is a graph showing the relationship between the SF value and the total market value. At the time of writing, gold has a market value of over $8 trillion.

[Source: Plan B on Medium]

Arguments against

When you make such an extreme prediction, that a bitcoin could reach a minimum of $55,000 and maybe even higher, it can not and should not go unchallenged. We have examined some of the main arguments against this hypothesis.

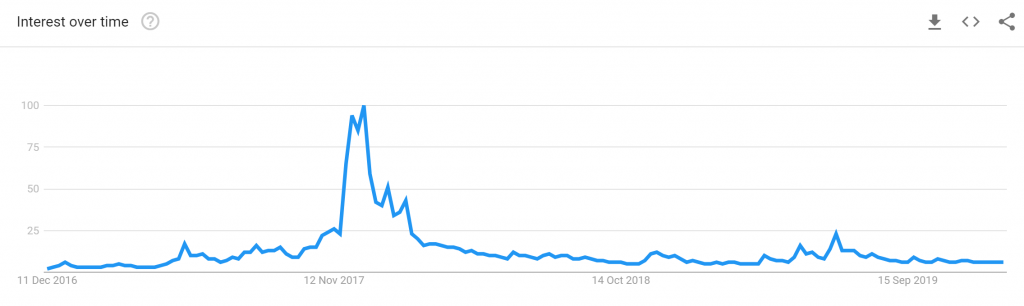

“The model only takes into account supply, not demand”. As pointed out by, among others, the Swedish crypto expert Eric Wall, demand is not part of the stock to flow model. Wall believes that it is the demand that drives price development, not supply. He argues that it is less important whether current production is 1, 2 or 0% as long as it is as low as it is. As long as the number of newly-produced bitcoins is below 5% in relation to the total supply, it is not the number of new bitcoins that matters, but the demand that is crucial, he argues. However, directly asked, Wall has been unable to provide accurate data that could back up his point of view, but does point to Google Trends data, which shows that the number of Google searches worldwide is correlated with the increase in Bitcoin’s price at the end of 2017. See the graph below:

Supporters of the stock to flow model have indicated that there are indications that Bitcoin is behaving in the same way as a so-called “Veblen good”.

It is a term that usually covers rare luxury goods such as diamonds and Rolex watches, characterized by a rise in demand as prices rise, partly because of a snob effect, as they signal an exclusivity. This is something that could also happen to Bitcoin in the event that price gets even higher than now. This is contrary to the general law of supply and demand, where demand is usually assumed to fall as prices rise.

Plan B, which has built the model, recognises that demand is not part of the model, but the same can be said about a lot of other factors that have an impact on price, such as regulation, hacking of crypto exchanges and so on. Nonetheless, the model fits, so even though the reality is very complex and influenced by many different factors, the model has so far presented a simple underlying structure that has been able to describe price trends.

Many ask: if the model is correct, “why hasn’t the market already responded?”. Assuming that the market is efficient and that the information about the model is widely disseminated as it is publicly available, the market should – if rational – respond to “get ahead”. However, it is possible that many investors, both new and more professional, do not yet know the model, or alternatively, they know the model but do not believe in it. It provides an investment opportunity for those who actually believe in the model. In any case, there are many examples of financial markets not behaving rationally, and it is, therefore, an open question of how good of an argument this is.

“Miners can give up Bitcoin and send the cryptocurrency down a death spiral”. Right now, it costs around $5,000-7,000 to produce a bitcoin for the miners who extract the cryptocurrency. Costs for professional companies may be slightly lower, as they often have access to very cheap electricity. If Bitcoin’s price falls below this level – and it happened recently in the fall-winter 2018 – then it could lead to a negative sales spiral as less profitable companies will stop mining Bitcoin and sell their holdings of the cryptocurrency. If the Bitcoin halving in 2020 does not have a positive impact on the price, then it could put the mining companies under pressure and have some throw in the towel. But even though less profitable companies are giving up, which is ongoing, many investors see it as a positive sign in the medium to long term, as historically such development has often marked the end of a downward market.

If you are interested in investigating these counter-arguments in more detail, we recommend listening to Stephan Livera’s podcast, where some of these arguments are reviewed.

Bitcoin halving could be a binary event, understood as that it can either send the price well up or well down. The reason that many cryptocurrency enthusiasts are positive about the opportunities is the asymmetry that lies in betting on Bitcoin in the slightly longer term. In the past, Bitcoin has repeatedly lost up to 80% of its value several times. That sounds tremendous, but when compared to the average market growth of 200% a year during the time when the cryptocurrency existed, it can give you the feeling that there is a lot to lose, but in return much more to gain. Should the market enter a new bubble and rise to $55,000, it would represent a 600-700% increase over the current level. Compared to this, a loss of 80% is actually quite modest, so even if you think Bitcoin has only a 30% chance of getting into another bubble of that size, then making that investment can mathematically make good sense.

If you have any arguments for or against an increase of this magnitude, reach out to us. You can write your opinion in the comment box below.

| At eToro you can trade 49 currency pairs, including several cryptocurrencies. Join eToro |