![]() The eToro trading platform is world’s biggest platform for social trading and copy trading, boasting no less than 6 million users spanning 170 countries. Its history dates back to 2006, when the company was founded in Israel. eToro offers trade based on CFD only, with more exotic products like cryptocurrencies (currently bitcoin, bitcoin Cash, ether, ripple, dash, litecoin, and stellar).

The eToro trading platform is world’s biggest platform for social trading and copy trading, boasting no less than 6 million users spanning 170 countries. Its history dates back to 2006, when the company was founded in Israel. eToro offers trade based on CFD only, with more exotic products like cryptocurrencies (currently bitcoin, bitcoin Cash, ether, ripple, dash, litecoin, and stellar).

The trading platform is provided by the company eToro (Europe) Ltd. (brokerage), based in Cyprus. Cypriot authority in this area, Cyprus Securities and Exchange Commission (CySEC) has allowed it to provide investment services. The fact that eToro is subject to cypriot authority and legislation means that they are also subject to the general EU-based financial regulation, including important customer protection regulation that applies to retail investors.

| eToro is the world’s leading brokerage platform for social and copy trading. A 1000 different products are available on eToro, divided into 12 stock indices, 7 commodities, 53 ETFs, 49 currency pairs, including several cryptocurrencies (e.g. Bitcoin and Ethereum). Leverage of up to a 100 (leverage degree differs for some assets) is available. In our opinion, eToro is the best regulated exchange. You can join eToro here |

Read also our article: Can I trust my trading platform?

Which type of trader is the platform suitable for?

eToro is structured around social trading and copy trading concepts in particular, and in these areas, the platform is clearly a leader on the market. But you can easily use the platform and their excellent graphs for regular CFD-trading. The product range is not the largest among competitors but should satisfy most needs. However, you should look out for exorbitant withdrawal fees and spreads of individual products.

In addition to the fact that one can completely automatically copy (in a more informative and transparent way) other good trades if you’re a good trader yourself you have the possibility to earn some extra money when others copy you.

The way you trade on eToro differs a little compared to many of the competing trading platforms. You invest a certain amount in a given trade and subsequently choose leverage, starting from 1 (no leverage) and going upwards (how much depends on the product in question).

When you open an account you automatically get a virtual account, where you can practice, get a closer look at the platform, and see how copy trading functions. If you want to open an actual account, you deposit at least 200 USD (it is recommended to open an account in USD, explained below). It is also reassuring to know that it is not possible to lose more money that there is on the account, which is not always the case in this industry.

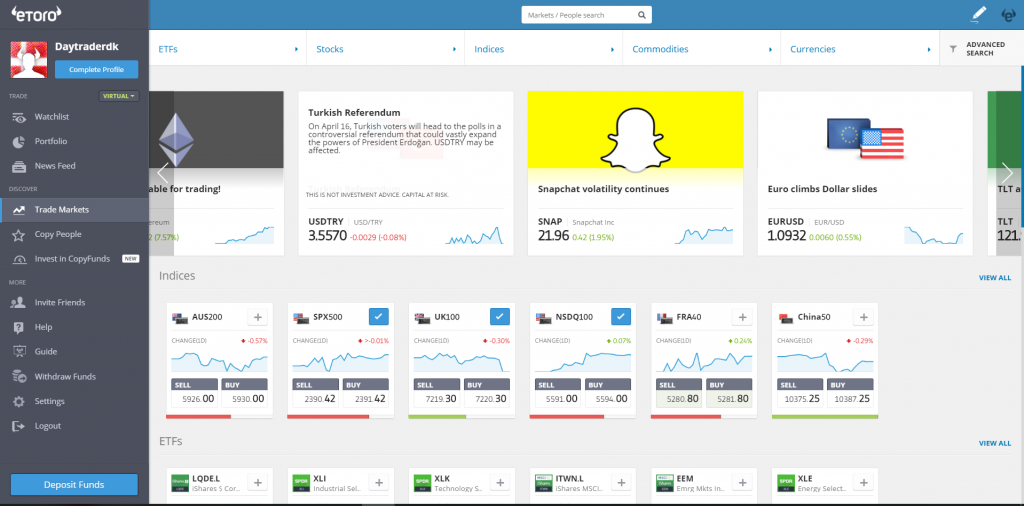

Design and trading platform

eToro offers trade via a web-based platform available across various devices, including mobile phones and iPads. The latest platform design was rolled out in late 2015, and has since been adjusted and expanded. Generally, the platforms are structured in the same way, so it is easy to go from one to another.

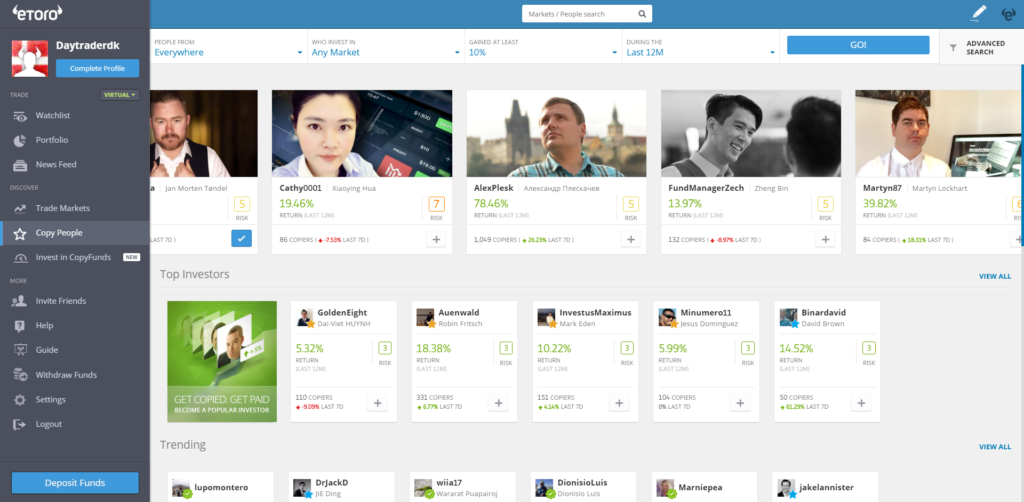

When you first log into your eToro account you’ll be met by a clear and easily understandable design. You have the same login access to your actual and virtual accounts. You can use the latter to test the platform, including copy trading features. All the important options can be found in a vertical bar on the left of the platform, and in there you can find prices, your portfolio, newsfeeds, markets, other traders you can follow or copy, support, etc. As a starting point you can see My Watchlist, which shows the prices of the chosen products. This can be customised as you wish, including creating more lists, which can also be seen in the form of boxes with individual products.

It’s possible to create simple price alarms for the individual products, so that you can for example receive a push notification when a given price level is reached. You do this by simply selecting a small tool wheel and clicking on Set Price Alerts. Here you can also customise your watchlist, if you wish to move the products around or delete them. If you want to add products, choose Trade Markets, and find the relevant products to add to your chosen list.

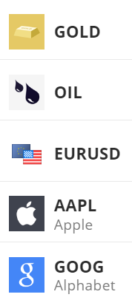

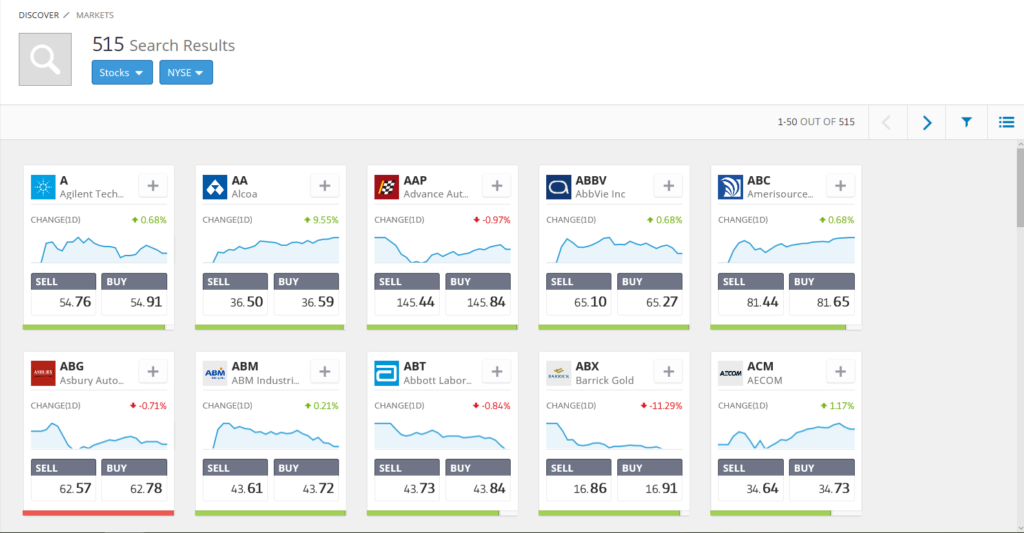

On eToro every single product is marked with a clear symbol so that all, amateurs and professionals alike, understand what it represents. For example, oil market is represented by two drops of oil, and every currency pair is marked with flags of the relevant countries. Where stocks are concerned, eToro has chosen to show individual stocks with their stock abbreviation, the entire company name, and the firm’s logo. This means that for example Apple (AAPL) shares are featured with the famous apple logo. It doesn’t get much more user-friendly, and other platforms could stand to learn something from this. Many platforms often release shares so intricate, that even traders have difficulty finding stocks they want to trade.

In addition to the individual products you also have the possibility to go directly to the product’s graph, information about it, research, newsfeed, as well as buy or sell it together with other investors interested in the product. The latter, called Sentiment, shows how many of eToros customers have gone short or long on the concerned product, given in percentages. Whether these types of information can really be used for something is an entirely different story. In the newsfeed you can see various traders’ comments about the markets, their portfolios, etc. It’s easy to find and click on listed markets and individual traders. On the right side you can customise your newsfeed, Popular Investors, and choose for example if you only want to see comments in English. Everything is clear and smartly done, but often these news will have little relevance to the “here-and-now” trade.

eToro has released various instructional videos on Youtube. For example, this 5-minute video.

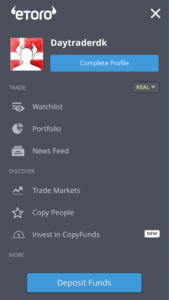

Mobile platform

The mobile platform can be found on Android and Apple IOS. It has been designed in the same way as the web-based platform, and provides access to virtually the same selection of functionalities. It is easy to make trades, copy other traders, see your portfolio, withdraw money, etc. All of this is facilitated by big and clear buttons – certainly necessary on a mobile, but not a given on every other mobile platform. The graphs are also displayed well, particularly on slightly larger phones. You can easily trade directly from the graph and modify it with different indicators. It is similarly easy to follow social trading section, read posts, etc. All in all, the mobile app is above average compared to competitors and can come in handy when you’re away from a computer.

Graphs

When you press directly on the graph symbol under the individual products, for example in My Watchlist, a separate window opens with a price graph (and nice interface), where the graph can be moved and expanded. It is possible to choose between around 70 technical indicators, which gives way to more exotic tools such as Gopalakrishnan Range Index or Donchian Channels. The graphical representation of the prices themselves can be reversed, for example to Heiken-Ashi or Renko. You can also add Fibonacci numbers to your graph, draw lines, measure, etc. It is such a pleasure to find so many possibilities for technical analysis in a trading platform that is technically not aimed at professional traders.

Besides being able to open a myriad of windows with graphs, it is also possible to choose a graph setup that can show 4 or 6 different graphs in one window. In order to really see something well, a slightly bigger screen is required, but it works fine regardless.

Graph packs, called Procharts by eToro, has been launched recently and is still in beta. While it’s not fully developed, it works quite well already. In some places, on the web platform, you must specifically select Procharts to access all of the options.

Trading

| At eToro you can trade 49 currency pairs, including several cryptocurrencies. Join eToro |

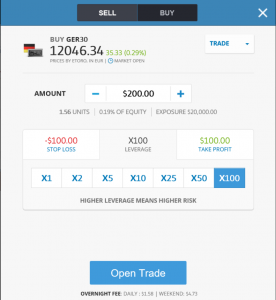

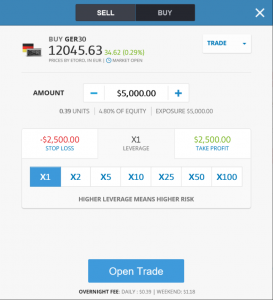

You should be aware that if you have opened your account in USD, all trades are done and settled in USD. This means that the stake you choose multiplied with the leverage constitutes your total exposure in each trade in USD, regardless of the currency in which the underlying index is traded in (see the order box below). A really useful feature is the possibility to choose leverage for the individual trades. As can be seen in the order box below, which shows the German G30 (DAX) index, it is possible to choose leverage of 1, 2, 5, 10, 25, 50 or 100 times the traded amount. The first order box (shown below) shows leverage of 100 (X100), while the one later in the text shows a trade with leverage 1 (X1). In reality, choosing leverage 1x (1:1) means that no “gearing” has been done. Which may be a good option for more cautious traders and especially for beginners, who may be worried about quickly losing their money due to hasty leveraging that is so often incorporated into CFD trades.

If you choose leverage 1x, the minimum deposit is 5.000 USD, which also reflects your exposure and margin. If you leverage 100:1 (100x), the minimum amount is 200 USD, which corresponds to an exposure of 20.000 USD and a margin of 200 USD. As can be seen, the leverage level affects the minimum required deposit. eToro makes use of units, a concept they invented. The number of units is calculated as ((Amount) * (Leverage)) / (instrument’s closing price the day before). The reason for it simple: it should be possible to trade smaller fractions of individual instruments when copy trading, where you can really hold a position close to 1 USD. You don’t need to worry about the number of units when making a trade, but rather the size of your order and naturally the leverage level so that you can control your exposure.

You can set your stake in the Amount field. The amount you choose is geared with the chosen leverage factor, marked with an X below the submitted amount. In the example above the chosen leverage factor is 100, which means that the staked amount of 200 USD has the exposure of 20.000 USD. The 200 USD is a required minimum amount with leverage 100x. The margin is 1% of the exposure. When you choose a lower leverage factor, the minimum required deposit increases. It’s not possible on DAX to carry out trades with exposure lower than 5.000 USD. DAX is currently traded at around 12.845 EUR, so eToro can only expose itself to around 5.000 USD at a time.

In the order box above you can also see trade’s deposit in relation to its Equity (i.e., netto balance). In this case, the amount corresponds to 0,19% of Equity that, as the order box was opened, amounted to around 100.000 USD (which is a fictive amount you can get in your virtual demo account). On the other hand, exposure is 20.000 USD due to the chosen leverage 100x, which is approx. 20% of Equity. You should pay attention to this. Taking the example above, you would bet 20% of your total balance.

Another interesting information to keep in mind concerns Overnight Fee, which is to be paid should you want to hold your position overnight. On DAX, it currently costs 1,58 USD to hold your position at a value of 20.000 USD per day, equivalent to an interest rate of around 2,8% (1,58/20000*360), which is reasonable. Holding your position over a weekend costs three interest days (calculated if you set the position Wednesday after 22, due a two-day valuation policy similar to those on the stock market).

If you don’t make use of leverage, your exposure and margin requirements will be the same. Unfortunately, you cannot always avoid fees when holding a position overnight. In the example above, it costs 0,39 USD per day to hold the position overnight, which corresponds to an interest rate of 2,8%, as calculated above. If you go long on a share, you pay no overnight fees.

When placing an order, stop loss and take profit levels are proposed (expressed in USD). They are set in relation to the initial invested amount. You can easily edit these levels, so that it may reflect your strategy and risk level. It is possible to set the levels at a given price level (Rate) or the invested amount (Amount). When you click on the Stop Loss button it is also possible to choose a so-called trailing stop loss. That means that if you choose the stop-loss of $50, the position will “trail” the price and automatically close if the price falls $50 from its highest level.

Another good feature can found on an instrument level, where you can set a predefined investment amount with associated fixed leverage and stop loss/take profit levels. At the same time, it is possible to do a “one click trade” on these instruments, which means that you can start trading quite quickly. In the beginning, you should be careful with this, as you may easily open positions you didn’t think through. Luckily, they are marked in grey in the price list, so it’s possible to see whether the feature is turned on or not. Features can be handled by choosing Settings on the left side of the web platform and then clicking on Trading. You will then see oversight of the chosen instruments you have already opened. They can also be edited and deleted here. It’s also possible to add new instruments to the list. All in all, a particularly useful feature, especially if you can master the one click function….

If you want to instead make trade orders when the price nears a given level, it is possible to do it in the same box as shown above, where you simply click on the TRADE field at the top right and choose ORDER instead.

Markets, products, and prices

eToro currently offers CFD-trade in over 1000 different products divided into 12 stock indices, 7 commodities, 53 ETFs, 49 currency pairs and a varying number of individual stocks from the bigger exchanges. The overall product range is not overwhelmingly large compared to most competitors, but it is possible to trade the most popular products, including for example Bitcoin and Ethereum (two biggest cryptocurrencies on the market, can be traded on eToro the whole week including Saturday and Sunday). The platform provides users with an overview of all products under Trade Markets (out on the left side) and then individual product categories. All eToro spreads can be found here.

As mentioned above you should be aware that all the products are traded in USD. If you open your account in this currency, your chosen leverage level represents the same overall exposure in each trade in USD, whichever currency the underlying index is traded in. It’s possible to choose leverage for the individual trades, which is quite smart. Regardless of the product, you can choose leverage ranging from 1x up to 400x. Leverage 1 means that you should put down 100% of the margin, and 400 means that only 0,25% in the margin is required. The latter leverage is outrageously risky and is certainly not recommended. An investment of 1.000 USD would result in the exposure of no less than 400.000 USD. To choose leverage 1 means to not leverage your products at all, which may be advisable for cautious and beginner traders, who may be concerned with losing their money as a result of leverage. For the majority of the instruments, you should still pay a fee if you hold a position for several days.

The fact that you can choose leverage for individual trades is naturally smart, but if you choose different leverage levels from trade to trade you can easily lose track of your overall exposure, as unfortunately, you can’t see the amount for your whole portfolio.

Opening times of the individual markets vary. Stocks can typically be traded when the individual exchange has opened, but for example, the German DAX Index can be traded between 8 and 22.

An overview of the market hours can be accessed here.

Stock Indices

Stock Indices

As mentioned earlier, it’s possible to trade 12 different stock indices from the biggest exchanges in the world, including for example Australia and China. Nevertheless, the combined total number of indices falls on the lower end of the range.

The majority of the biggest exchanges, such as the German G30 (DAX), offer leverage factors of 1, 2, 5, 10, 25, 50 or 100. If you choose leverage 1 you should trade for at least 5.000 USD, which reflects the same minimum exposure. If you leverage 100x, your minimum deposit is 200 USD, which corresponds to the exposure of 20.000 USD. It can be seen then that the level of leverage affects your minimum deposit.

When it comes to spreads, there is a wide product variety. For example, you can typically trade DAX (G30) or FTSE (UK100) with a 2 point spread, while Dow Jones (US 30) can be traded with a 6 point spread, which is quite high compared to other brokers. The Japanese index can be traded to 10 points. It can be mentioned that as a starting point DAX can be traded to 2 points between 8 and 22. With a lot of the competing brokers, the spread is usually higher outside the market hours of the underlying exchanges, for DAX it is 9-17:30.

Currency pairs

Currency pairs

It is possible to trade close to 50 currency pairs, which should cover most people’s needs. For the bigger currency pairs like GBP/USD and EUR/USD, it is possible to leverage from 1 up to 400. If you trade without leverage, you have to trade for at least 5.000 USD, while leverage 400x can be done with 25 USD corresponding to the exposure equal to 10.000 USD.

When leveraging 400:1 you should be careful with your money, and it is strongly advisable not to use the higher leverage levels before you are fully aware of all the risks and what you’re doing. Otherwise, you won’t be doing it for long.

Spread-wise you can trade USD/YEN to 2 pips, GBP/USD to 4 pips, and EUR/USD to 3 pips. When it comes to currency, eToro is not among the cheapest on the market.

Commodities

Commodities

The range of available commodities is limited to 7 different types. Namely gold, silver, natural gas, copper, oil, palladium, and platinum. Overall, it’s not the largest commodity product range on the market, but the most important ones can be traded. Commodities can be typically geared from 1 until 100. Without leverage, the minimum trade is 2.500 USD, while leverage 100 requires a minimum 25 USD, with 2.500 USD in exposure.

Gold can be typically traded with a spread of 0,45, and oil can be traded on 0,05.

Stocks

Stocks

It’s possible to trade around 1000 major liquid CFD-based stocks from exchanges in the US, Germany, England, France, Spain, Italy, and Switzerland. For example, it’s possible to trade 515 stocks from the New York Stock Exchange, 194 stocks from Nasdaq, and 27 stocks from the German exchange in Frankfurt. You can see the full list of available stocks here.

When you trade CFD-based stocks on eToro you don’t pay for brokerage, as you do when trading the underlying listed stocks. On the other hand, you pay a higher spread compared to trading directly on exchanges. Let’s take an example. In April 2017 the bid-ask of BMW was 83,55 at 83,57, equivalent to the spread of 0,02 point. At the same time, the bid-offer with eToro was 83,45 at 83,67, equal to 0,22 point or around 10 times as high as the other exchange. While the spread was relatively high with eToro, it may well be cheaper to trade the stocks in question as CFD, especially if you’re trading smaller positions at a time. This is due to the fact that during traditional stock trading with for example banks, and especially with foreign stocks, there are often high brokerage fees, trading fees, etc., which can be avoided if you use eToro.

Individual stocks can be typically leveraged between 1 and 10, which means that you should put down between 10%-100% in the margin. If you buy with a factor of 1, the size of your position equals the exposure. The only difference in relation to common stocks is the tax calculation – CFDs are traded as financial contracts and therefore capital income, while normal stocks are taxed as equity income.

Cryptocurrencies

Cryptocurrencies

It is possible to trade several cryptocurrencies, including ether, bitcoin, bitcoin cash, ripple, dash, litecoin and stellar. It’s only possible to purchase these cryptocurrencies without leverage, which means that you don’t pay for overnight position holding. You trade actual coins when you go long. If you sell (short) instead, you can do it via a CFD contract, which triggers the overnight holding fee. However, the fee is not that high (close to 2% per year). It is not possible to leverage when shorting. Bitcoin is typically traded with a 150 point spread, which is at the moment 1,5%, while Ether is traded with a spread of around 18 points or circa 1,9%. Because of the size of the spread you need to be careful not to trade too much. The relatively high spread should naturally be seen together with extreme fluctuations that occur daily within the cryptocurrency environment. If you trade your cryptocurrency on eToro you don’t have to open a wallet for storage. It is not possible to transfer funds neither to nor from an eToro account. You can trade as little as 200 USD at a time in different currencies, which at the same time equals one’s exposure.

| At eToro you can trade 49 currency pairs, including several cryptocurrencies. Join eToro |

Other fees

It is important to be aware that with eToro it costs at least 25 USD to withdraw money (at least 50 USD withdrawal is required). This is unheard of and thankfully not seen in many of the competitors. In addition to this exorbitant fee, you should be aware of currency exchange costs – when you, for example, transfer your local currency to eToro using your VISA, you need to remember that the platform requires to receive all the funds in USD. If you opened your account in EUR you will be charged additional exchange costs from eToro’s side (and again when you withdraw your money). A bit of good advice is then to keep your account in USD (be aware that there is an additional exchange risk involved) and not withdraw money over and over again.

You are also charged with an inactivity fee of 10 USD per month if you don’t log into your account within 12 months (4 months for non-depositing accounts). The fee is charged only if there is money on the account.

The overnight fees, charged when you hold a position overnight, can vary or depend on individual instruments one trades. The list of fees can be seen in the link below. It’s easier to see the fees in the order box when making trades, as the exact fee for that position can be seen there. The fees to trade on DAX were around 2,8% at the time of writing, which is not unreasonable compared to competitors. Often the fee is lower at short positions, but the charges for individual instruments can be quite high. It may then be sensible to keep an eye on the fees over a longer period of time.

A detailed explanation of the above and a fee structure overview can be found here.

All in all, eToro should be praised for clearly explaining spreads, withdrawal and overnight fees. The last in particular is something that some competing platforms hide a bit. It’s clear that withdrawing money costs a lot of money, and the fact that it’s stated clearly may not necessarily offset how expensive it is. It’s quite audacious to charge such a high fee for something as simple as transferring the money back to a user’s account.

It should also be mentioned that the spreads you pay can be reduced if you as a trader can manage to get other traders to copy your trades. In that case, you will be included in eToro’s “Popular Investor Program”, which translates into a reduction in spread as well as a monthly check from eToro. See more under “Social trading and Copy trading” later in this review. It’s a great opportunity for skilled traders in particular.

Education

eToro has a so-called Trading Academy, made up of three sections: Live Webinars, eCourse, and Trading Videos. At the time of writing, there were no Live Webinars scheduled and no evidence of recently hosted ones. A handful of trading videos that are available are quite basic (even when they are called “advanced”). On the other hand, they are educational and easy to follow, so they function well as a starting point for novice traders or as a refreshment for more practised traders. All in all, eToros Trading Academy offers nothing extraordinary.

On YouTube, you can find a number of videos that go in-depth into how to use this trading platform, for example, this one (26 minutes).

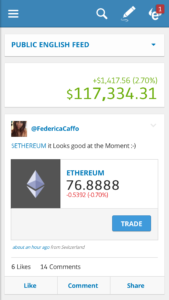

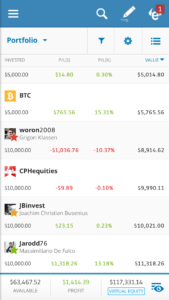

Social trading and Copy trading

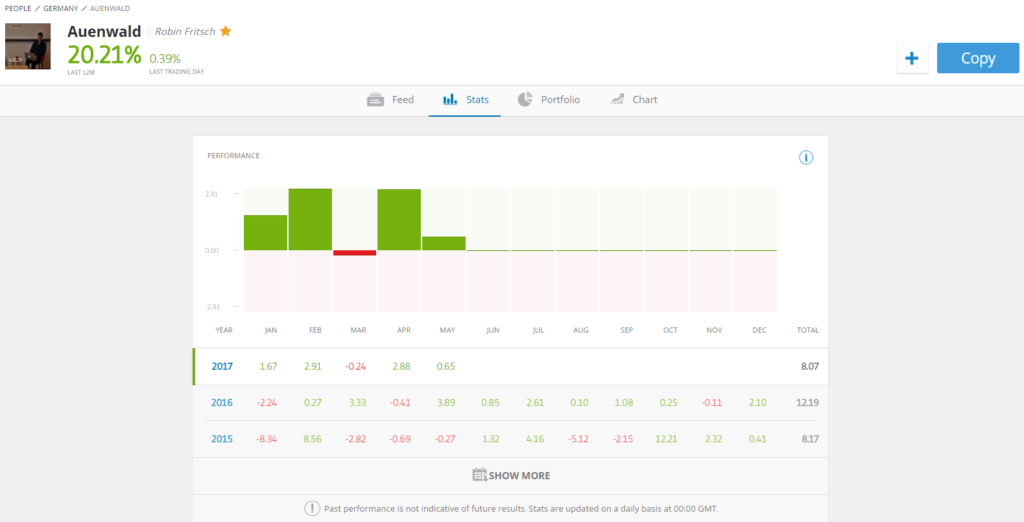

eToro has been built from the ground up as a social trading platform, and it is within the social that the platform truly shines and distinguishes itself from competitors. All traders with an account with eToro have a profile and a newsfeed, just as Facebook. You can like, comment, and share each other’s posts, as well as see each other’s portfolios, and a ton of statistics relating to how a given person has fared in the short and long term (it is also possible to turn this function off if you wish to be anonymous). eToro also calculates the risks taken by traders, which may help to sort out the traders who may have gotten lucky in a period where they also ran a big risk, see the details below. Posts and comments in the newsfeed can help inspire your own trades, but you also have the possibility to simply copy trades of selected traders entirely automatically. The functionality is called Copy Trading, and it’s the function that attracts many traders to eToro. Traders can be found on the left side under Copy People. Majority of amateurs have a dream of being able to trade exactly like professional and successful traders, and the Copy Trading function gives you precisely that ability.

Copy Trading functions really well. When you find a person you want to copy, simply press on the button “Copy” under the person’s profile, and the trading platforms copies open trades fully automatically. The subsequent new trades are copied in a similar manner. You choose for yourself how much of your resources to allocate for this purpose. The proportion of resources you have chosen to allocate reflects the person’s portfolio, and you can trade in fractions of positions, in case you can only allocate a small amount. You can invest as little as 100 USD in every trader. When you first start copying, you will be asked to consider a fixed stop loss, so if the person suddenly loses 50% of his/her invested capital, all open positions are automatically closed. It is also possible to close individual positions if you do not want them.

It sounds almost too good to be true. And it can be if you don’t pay attention. Statistics can be read in various ways, it can become an art in itself to actually assess which of the thousands of eToro traders are good and which are bad. Especially over a longer period of time. In order to find a successful trader, most people will intuitively simply search for how profitable individual traders have been in a given period of time. But the achieved profit doesn’t say much about risk, other than a high profit typically reflects high risk. Often traders who take on the highest risk are also the traders that score the highest profit in a given period of time. However, it is also the same traders that a month later may risk losing all the rewards (and more) again. Luckily, eToro provides a risk score concerning the specific period you are looking at. This makes it possible for risk to be taken into account, and to sort out the most risk-prone traders.

CopyFunds

eToro has also recently launched Copyfunds, “Top Trader CopyFunds” and “Market CopyFunds”. The former contains the expected best performing (according to various criteria) traders on eToro, while the latter bundles CFD based shares, commodities or ETFs following a pre-selected market strategy. You should deposit a minimum of 5.000 USD in every fund. Read more about the different funds here, or under Invest in CopyFunds on the platform. The funds can also be transferred to a watchlist. You can try out investing in the practice account.

| eToro is the world’s leading brokerage platform for social and copy trading. A 1000 different products are available on eToro, divided into 12 stock indices, 7 commodities, 53 ETFs, 49 currency pairs, including several cryptocurrencies (e.g. Bitcoin and Ethereum). Leverage of up to a 100 (leverage degree differs for some assets) is available. In our opinion, eToro is the best regulated exchange. You can join eToro here |

Customer Service

eToro provides 24-hour customer service from Monday to Friday, but support is delivered first and foremost with the help of the internal mailing system, Live Chat, or general questions submitted to Customer Service newsfeed. Replies are received between 1 and 4 days. There is no phone number for the Broker Service Center, only a fax number. This is clearly negative, as apparently, you cannot contact the Broker Service directly when you need them.

Deposit security

eToro stores customer’s funds separately from their own resources in accordance with EU’s financial regulation and MiFID via so-called segregated customer accounts. This means that one account is held separately from a broker’s own funds in a potential bankruptcy situation.

In addition, in case of eToro’s bankruptcy, private customers are insured with up to EUR 20,000 per customer under Cypriot legislation (which is, again, EU-based).

As eToro is subject to relatively strict EU requirements regarding providing financial services, the company does not differ significantly from the other providers on the market. Some countries in the EU, for example, England, have a better customer protection regulation, for example in the form of higher economic protection for the individual customer.

Conclusion

eToro has a clear and user-friendly design, and the platform offers surprisingly many technical tools if you want to analyze a price graph. At the same time, less experienced traders can find inspiration in the social element. If they can find the best traders, they can set up an automatic copy of their trades. If you are a skilled trader, eToro’s Popular Investor Program can be a good opportunity to trade cheaper. You can also create a social profile that in the long term can yield some extra income, provided that you are able to deliver a certain return.

Another area that deserves praise is the possibility to choose the exact leverage that suits one’s risk willingness.

On the negative side, it is clear that individual products are offered with some disproportionately big spreads, but as stated earlier, this is not always the case. You have to watch out for this. If you apply to become a part of eToro’s Popular Investor Program and manage to be copied by at least one other trader, after two months you receive a 20% spread discount. The range of markets and products is not entirely in line with some other providers on the market. Another annoyance is exorbitant fees charged when withdrawing money.

If you have your trading account in a foreign currency, you should be aware of the disadvantage it implies. Downsides are clear when it comes to calculating tax on one’s profit, which should be converted into your local currency. Additionally, all else being equal, it is easier to review one’s margin, exposure, etc. in your local currency without having to convert it all the time. The latter can naturally be a matter of taste, but having said that, you will quickly get used to the foreign currency. And since both investment, margin, and exposure are kept in the same currency, you avoid exchange costs normally charged when trading with instruments settled in EUR or GBP. Moreover, you naturally run a currency exchange risk on your account balance in relation to changes between USD and your local currency. And when you withdraw your money, you will be hit by the costs in your local currency.

On the other hand, eToro guarantees that you will not lose your account balance, which is a clear advantage.

When you open an account with eToro you automatically get a virtual account. If you also want to open a live account you can easily do it from the same location, and you can access them with the same login. We recommend you to try out the virtual account by clicking the link below.