Privacy coins have been steadily gaining traction in the crypto world. They offer what Bitcoin was supposed to: absolute privacy. Just as stablecoins are the “holy grail” of crypto, privacy coins aim to fulfil Bitcoin’s original promise: full financial freedom and total anonymity at the same time.

In this article we explain what privacy coins are, why are they useful, where to buy them and a few things to keep in mind before you do.

Table of Contents

What are privacy coins?

Supporters and creators of privacy coins state that the main goal of privacy coins is to fulfil the original promise of cryptocurrencies: financial freedom and privacy.

This means that privacy coins enable peer-to-peer (P2P) transfers without an intermediary, but the transfers are anonymous. It is impossible to decipher who sent what to whom – the ledger’s history is not broadcasted like in other cryptocurrencies.

Hang on, isn’t Bitcoin anonymous?

The short answer is: no it isn’t. Although Bitcoin could be considered private, it is not anonymous. What’s the difference? Bitcoin addresses contain no identifying information, such as your name, etc.. However, Bitcoin’s transaction ledger is public, which means that you can see that an address sent an amount, how much that amount was, and which address received it. That is not that bad. However, if you were to withdraw your money from an exchange or purchase something with bitcoins at a merchant, there is a probability that your identity will be linked to your Bitcoin address. And from there, all your previous transaction history can be easily seen, thanks to the immutability of the ledger.

Are privacy coins solely used by criminals?

No. The main medium of exchange for criminals is still the good old’ dollar, which has recently been admitted by an official from the US Treasury – terrorists use mostly cash, not crypto.

Initially, Bitcoin was used in large part for illegal activities, for example, the infamous Silk Road between 2011 and 2013 when it was shut down. But once the mainstream heard about BTC and other cryptos that number went down dramatically. Due to Bitcoin’s public ledger, all the information could be deciphered. So if we want to decrease crime, we just need to get the criminals to use Bitcoin.

But what about privacy coins? Well, these do pose a threat, as admitted by authorities. For example, a recent report by the US said that cryptocurrencies pose a real threat, due to their anonymity. Now, the report does not specify which cryptocurrencies. Another study has found that the percentage of Bitcoin’s use for illegal use is decreasing, with criminals turning increasingly towards privacy coins, the favourite one being Monero.

Also, when thinking of criminals you might have a mental image of a hacker trying to steal information or money. The type of criminal many government agencies are worried about are people who do not report their crypto incomes and avoid paying taxes. For example, the Internal Revenue Service (IRS) – the tax collection agency of the US, has partnered up with Chainalysis to track Bitcoin usage for precisely that purpose.

Why are privacy coins useful?

Why should you care about privacy coins? Because we are living in an increasingly surveilled world. Some countries, like China with their social credit system take it to the extreme, and thanks to whistleblowers like Snowden we know that even democratic governments including the US and the UK have a vast surveillance network over their citizens. You are entitled to your privacy, and privacy coins are your possibility to exercise it.

Using privacy coins means that your government can’t track you. This may be especially relevant in countries which are less than enthusiastic about cryptocurrencies, like India or Pakistan, or if you’re worried about the government looking into every aspect of your life like previously mentioned China. The anonymity of transactions via privacy coins also prohibits for-profit companies (e.g. Google) from tracking your data. In this day and age, information is power, and your data should not be a commodity.

And finally, it’s also a question of safety and security. “There is the obvious consideration about privacy being a human right…but then there is a huge issue of security. Having financial information public or semi-public is extremely dangerous. The only way to provide security for the average user is to allow them to keep some information private”, said Fernando Gutierrez, Chief Marketing Officer of Dash. Having your transaction broadcasted to the world, be it in fiat or Bitcoin, leaves you open for an attack. There have been numerous instances of phishing attacks (for example, Binance in May 2019), and the black market for stolen financial data is a booming business.

| At eToro you can trade 49 currency pairs, including several cryptocurrencies. Join eToro |

Things to keep in mind (privacy coin issues)

Due to their potential for criminal use, some governments have cracked down on some privacy coins. For example, Japan, overall a very crypto-friendly country (Bitcoin is considered a legal tender, and crypto regulation has been introduced fairly early), has disallowed (licensed) exchanges to support privacy coins due to concerns of the potential for money laundering.

One of the most recent examples involves Zcash and Coinbase – originally listed in November last year, Coinbase has recently dropped the coin from its listing in the UK due to its new banking partner.

Speaking of Coinbase, you might want to know that when IRS came knocking on their door in 2016 asking for customer’s data Coinbase, after resisting for almost 2 years, forked them over in 2018. They now have a policy of cooperating with authorities. So if you’re against having your transaction data shared by your exchange or wallet be sure to check their policies regarding this.

Privacy coins could have trouble being adopted because of the dominance of other coins. And if the bigger coins were to start to implement privacy elements, privacy coins could be in trouble. Ethereum, for example, is the second biggest crypto and it’s possible they might implement zk-SNARKs (explained below) in the future. Bitcoin and Litecoin are considering MimbleWimble (blockchain protocol that would improve both privacy and scalability). However, given the regulatory issues that might cause, it remains to be seen if those elements will actually be implemented.

What privacy coins are there?

Monero (XMR)

Created in 2014, Monero is currently the biggest privacy coin (top 15 cryptocurrencies on Coinmarketcap). After a rocky start, Monero gained a lot of traction in 2016. Due to its anonymity, it is often used by criminals. In 2018 Monero was used in 44% of attacks. Contrary to many other cryptocurrencies (even private ones) Monero is anonymous by design. But you can also choose a level of transparency.

Monero has a number of features that ensure that nobody can find out who sent how much to whom. Senders are protected by ring signatures, recipients are hidden thanks to stealth addresses, and the amount remained anonymous thanks to so-called Ring Confidential Transactions (RingCT).

Ring signatures

Ring signatures are the way Monero hides the source of the transaction, protecting the sender.

In short, when you digitally sign an XMR transaction several other past transaction outputs are taken from the Monero blockchain to form a ring made from one real transaction (yours) and decoy ones. It is impossible to determine which output actually sent the transaction. In order to avoid double-spending, each transaction has a distinctive image key (and it is impossible to find out which image key belongs to which transaction) that allows miners to verify a transaction and thus prevent double-spending.

Ring signatures are explained in this short video by Monero:

Stealth addresses

While ring signatures are used to protect the sender, stealth addresses obscure the destination of a transaction, protecting the recipient.

When a sender sends Monero, a random one-time address is generated for each transaction. So even if you send multiple transfers to one address, the blockchain shows these transactions as transfers multiple addresses. This makes it impossible to determine the link to the recipient’s address. The recipient can then use his or her private view key to find transactions meant for them.

You can find out more about Monero’s stealth addresses in the video below:

Ring Confidential Transactions (RingCT)

Besides hiding both the source and the destination of a transaction, Monero also masks the amount sent using Ring Confidential Transactions (RingCT). RingCTs were implemented in January 2017 and became mandatory in September that year.

Currently, if Monero is transferred for the first time, RingCT outputs with masked amounts are generated. This makes it impossible for anyone besides the sender and recipient to know the amount being sent. In order to prove the validity of a transaction, the input and output of each transaction have to be the same. So when a sender sends their full output (e.g. 10 XMR) and transfers a given amount (let’s say 3 XMR) he or she receives the rest of their output as change (in this case, 7 XMR). A sender has to commit to the output’s amount – in this way the minimum amount of information is revealed to fully validate a transaction.

If you’re interested in the technical details of this feature, read this paper. And here is how Monero explains RingCTs:

Dash (DASH)

Dash (DASH)

Dash is not the most popular privacy coin (that mantle belongs to Monero), but it is in the top 20 cryptocurrencies. Created in 2014, Dash aims to be digital cash with a focus on speed (InstantSend) as well as privacy (PrivateSend).

PrivateSend

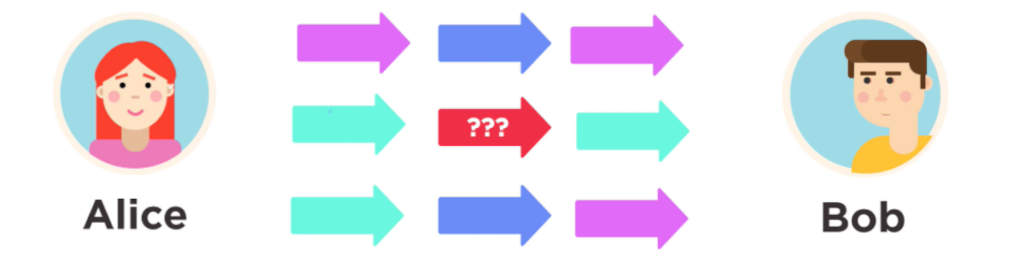

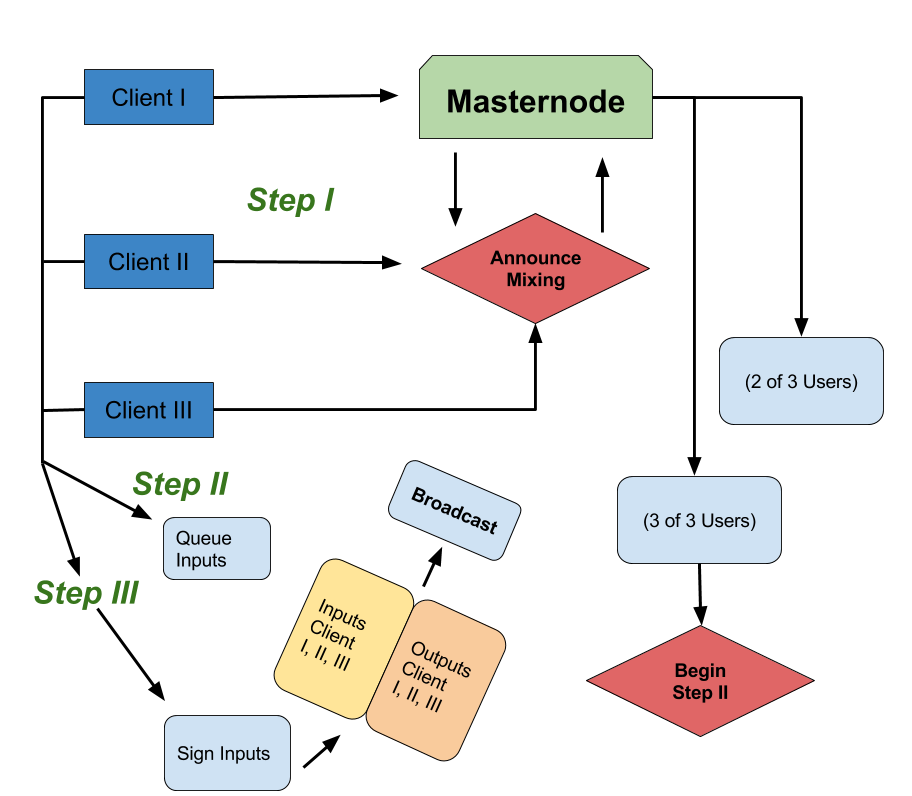

PrivateSend anonymises the source of a transaction by mixing several transactions from different people. First, your transaction input is broken down into specific denominations (0.001, 0.01, 0.1, 1 and 10 DASH) which are then mixed with inputs from at least two other people. The mixing is facilitated by a masternode. In order to be fully anonymous, that process is repeated several times (called “rounds”), you can choose between 1 and 6 rounds.

We have covered Dash previously, you can find more information about Dash, its history, and features in this article.

Zcash (ZEC)

Launched in 2016 as a fork of Bitcoin, Zcash is currently in the top 30 cryptocurrencies. Zcash is the first mainstream application of zk-SNARKs – an innovative form of cryptography (explained below). The protocol of the coin has been developed by scientists from various renowned institutions, including MIT, Johns Hopkins, and UC Berkeley.

Launched in 2016 as a fork of Bitcoin, Zcash is currently in the top 30 cryptocurrencies. Zcash is the first mainstream application of zk-SNARKs – an innovative form of cryptography (explained below). The protocol of the coin has been developed by scientists from various renowned institutions, including MIT, Johns Hopkins, and UC Berkeley.

zk-SNARKs

The name of zk-SNARK stands for Zero-Knowledge Succinct Non-Interactive Argument of Knowledge. Zero-knowledge proofs allow you to prove that a statement is true or that you are in possession of some information without actually revealing the information. Succinct part of the name refers to the fact that verification can be done in milliseconds. And thanks to the non-interactive structure the verification can be done in a single message, without the need to go back and forth between the two parties.

We won’t go into the technical details here, but if you’re interested in that you can read Zcash’s documentation available here.

| eToro is the world’s leading brokerage platform for social and copy trading. A 1000 different products are available on eToro, divided into 12 stock indices, 7 commodities, 53 ETFs, 49 currency pairs, including several cryptocurrencies (e.g. Bitcoin and Ethereum). Leverage of up to a 100 (leverage degree differs for some assets) is available. In our opinion, eToro is the best regulated exchange. You can join eToro here |

Verge (XVG)

Verge was created in 2014 and was originally named DogecoinDark. In 2016 the name was changed to Verge. Although the coin is much smaller than previously mentioned ones (currently at rank 72 according to Coinmarketcap) it is interesting to mention, as Verge’s privacy does not come from cryptography.

Verge was created in 2014 and was originally named DogecoinDark. In 2016 the name was changed to Verge. Although the coin is much smaller than previously mentioned ones (currently at rank 72 according to Coinmarketcap) it is interesting to mention, as Verge’s privacy does not come from cryptography.

Similar to Bitcoin, Verge is a public blockchain. However, it is not fully anonymous. Pseudo-anonymity is possible thanks to features mentioned before, namely stealth addresses and RingCT.

The main privacy feature claimed by Verge is the integration of its network with TOR (“The Onion Router”) – an IP service that masks the location of your computer. Another important integration is I2P (the Invisible Internet Protocol), which allows anonymous P2P communication.

It is important to note that Verge has been heavily criticised, and for good reason. This Hackernoon article gives a comprehensive overview of Verge’s issues, pointing to the fact that XVG’s solutions are inadequate, as the past successful linking of addresses to people has been done by tracing transactions on the blockchain, rather than by tracking someone’s IP. Speaking of IP, you can also run Bitcoin via Tor (but it may not be as safe as you think), so that solution could be considered unnecessary. In Verge, privacy is optional. Which means that if you were to go for the private option there are fewer people you can hide among. This may not be an issue for a cryptocurrency with a big market cap, but it is definitely an issue for Verge. And finally, the privacy features available are not original, with other cryptocurrencies having implemented them before.

Which privacy coin should I choose?

There are several privacy coins to choose from. In this article, we have focused on Monero (XMR), Dash (DASH), Zcash (ZEC), and Verge (XVG). Each of them (except for Verge) offers different ways of ensuring your privacy.

Monero is the privacy coin leader, with privacy built into it, and some transparency being an option. Dash’s PrivateSend option is easy to use (how to send DASH using PrivateSend?). But both Monero and Dash use a public ledger. Zcash on the other hand only records the time of the transaction and no other transaction data is provided. Thanks to zk-SNARKs, Zcash is able to verify transactions without publishing information about either party. It was also called referred to as the “most interesting Bitcoin alternative” by Edward Snowden.

Choose your privacy coin based on your preferences – is anonymity essential for you, or is increased privacy enough? Do you want privacy to be an option, or a default when you transact?

All of the privacy coins described here are available on Binance. You can buy Zcash on the regulated exchange etoro as well.